Business Insurance in and around Holly

Get your Holly business covered, right here!

Almost 100 years of helping small businesses

Insure The Business You've Built.

Running a small business comes with a unique set of highs and lows. You shouldn't have to deal with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including business continuity plans, worker's compensation for your employees and a surety or fidelity bond, among others.

Get your Holly business covered, right here!

Almost 100 years of helping small businesses

Get Down To Business With State Farm

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a dry cleaner, a cosmetic store or an interior decorator. Agent Mark Carney is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

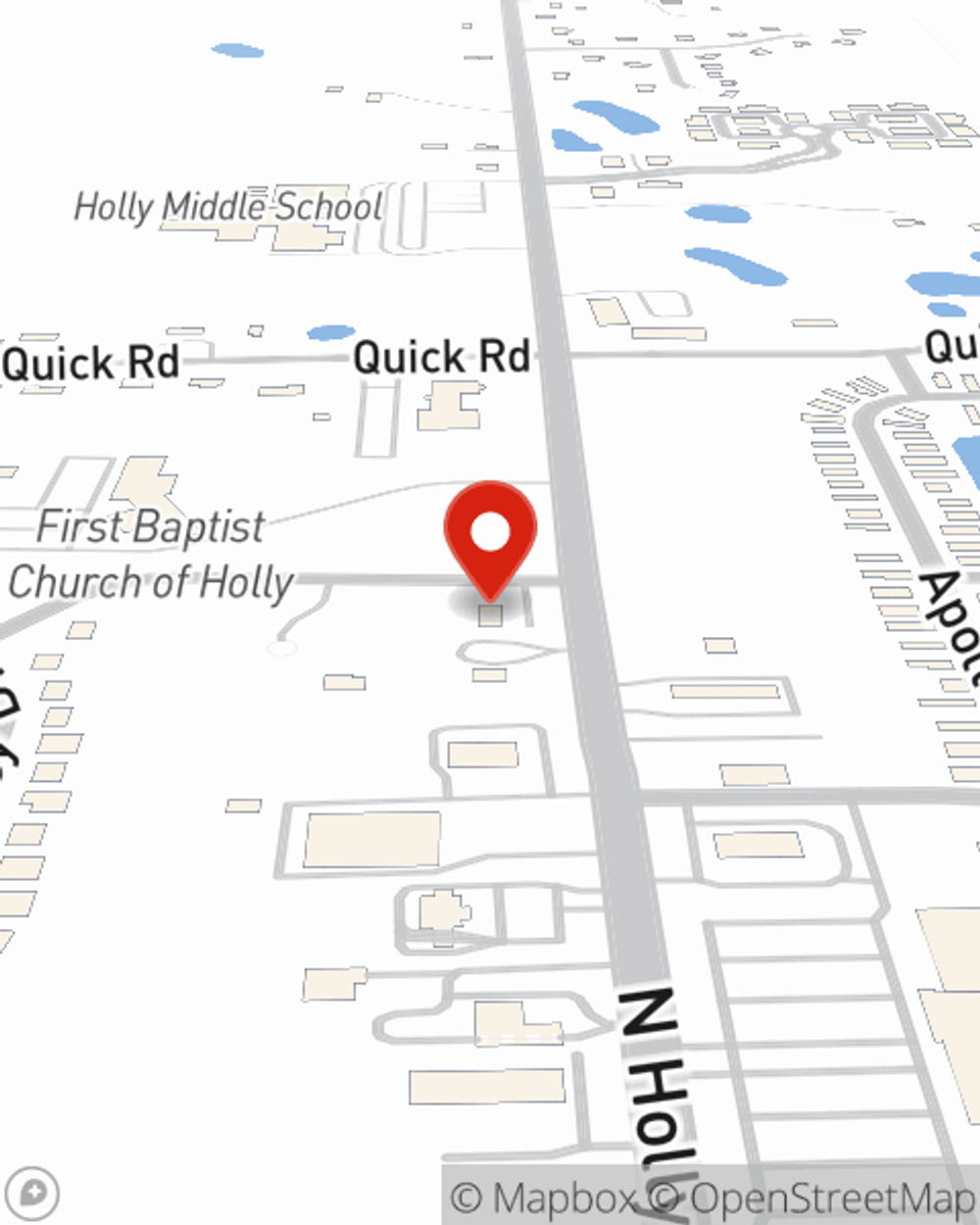

Reach out agent Mark Carney to review your small business coverage options today.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Mark Carney

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.